Overview

Credit union elections play a crucial role in democratic governance, empowering members to elect representatives who truly reflect their interests. Governed by specific bylaws, these elections ensure fairness and transparency, which are essential for maintaining trust within the union.

To enhance voter participation, it is imperative to implement effective communication strategies, educational initiatives, and secure online voting systems. These approaches not only foster member engagement but also uphold the integrity of the electoral process, ultimately strengthening the democratic foundation of credit unions.

Introduction

Credit union elections represent the cornerstone of democratic governance within these member-owned institutions, empowering individuals to choose representatives who advocate for their interests. Understanding the intricacies of this electoral process enables participants to play a crucial role in shaping the future of their credit unions. However, challenges such as low voter turnout and compliance issues threaten the integrity of these elections.

How can credit unions ensure a successful and inclusive electoral experience for all members? This question not only highlights the urgency of the situation but also calls for immediate action from union leadership.

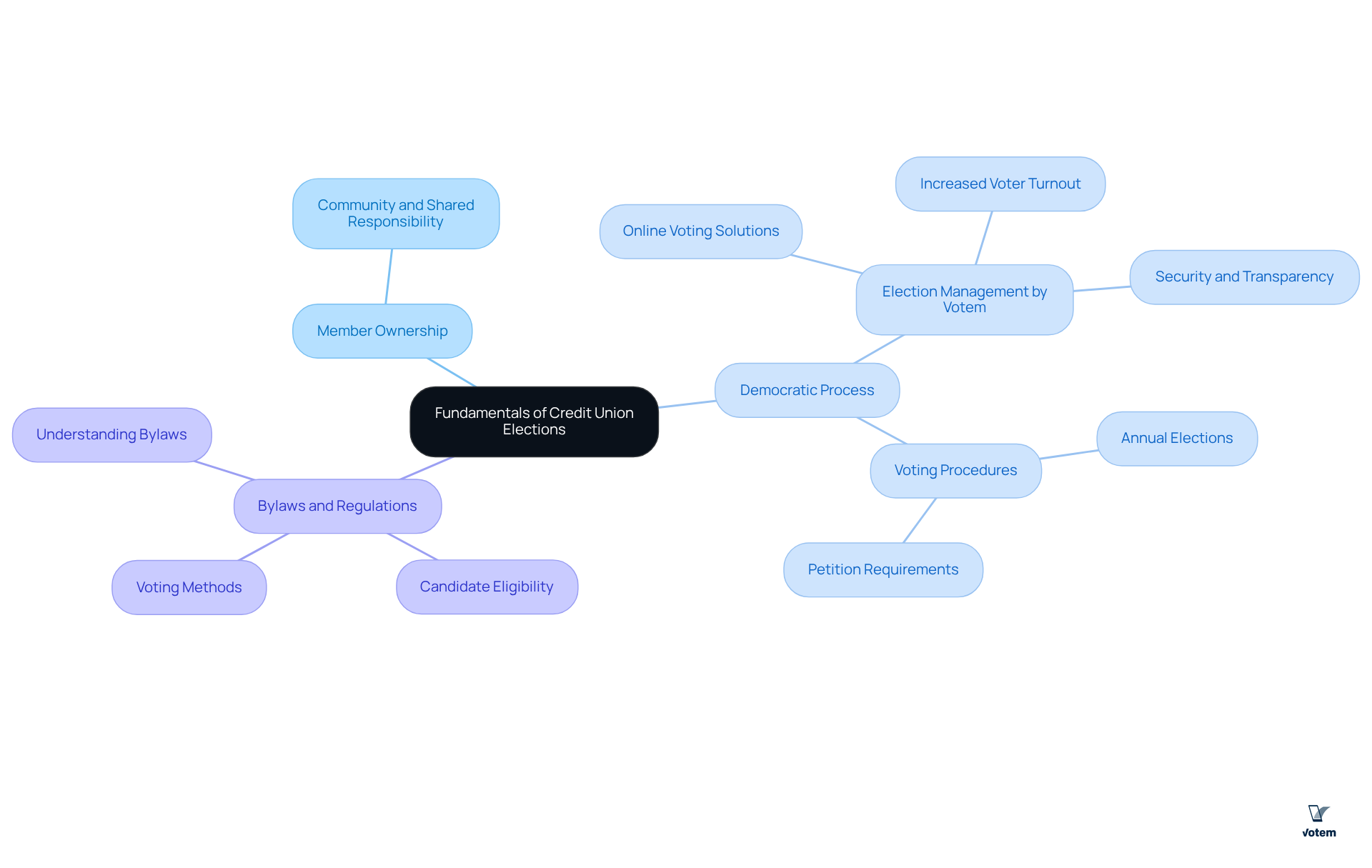

Explore the Fundamentals of Credit Union Elections

Credit union elections play a vital role in governance by empowering participants to choose representatives who advocate for their interests. Unlike conventional banks, credit unions operate under a cooperative model, meaning every participant has a voice in decision-making processes. These credit union elections typically occur annually and are governed by specific bylaws that delineate the procedures for nominations, voting, and announcing results. Understanding these fundamentals enables participants to appreciate their role in shaping the future of their credit union and ensures they are prepared to engage actively in credit union elections.

Key aspects include:

- Member Ownership: Each member is a part-owner of the credit union, fostering a sense of community and shared responsibility.

- Democratic Process: Credit union elections are conducted to ensure that leadership reflects the will of the members, thereby enhancing transparency and accountability. Votem’s groundbreaking have proven effective in managing large-scale contests, as demonstrated by their oversight of 299,000 votes for the National Radio Hall of Fame, significantly boosting participation compared to previous years. Votem employs cutting-edge technologies to streamline the electoral system, ensuring security and accessibility for every voter.

- Bylaws and Regulations: A thorough understanding of the credit union’s bylaws is essential, as they govern the credit union elections process, including candidate eligibility and voting methods. Votem’s commitment to improving accessibility has led to increased voter engagement, particularly among military voters and individuals with disabilities, ensuring that all participants can fully engage in the electoral process.

As L. Scott Gribbons, a current board representative, emphasizes, ‘Nominations for the 2025 Board of Directors are now open,’ which highlights the ongoing commitment to stakeholder engagement and democratic governance through credit union elections. Additionally, testimonials from satisfied clients highlight Votem’s effectiveness in enhancing voter turnout and maintaining voting integrity. The cooperative model not only bolsters member ownership but also significantly enhances engagement, ensuring that members feel invested in the future of their credit union.

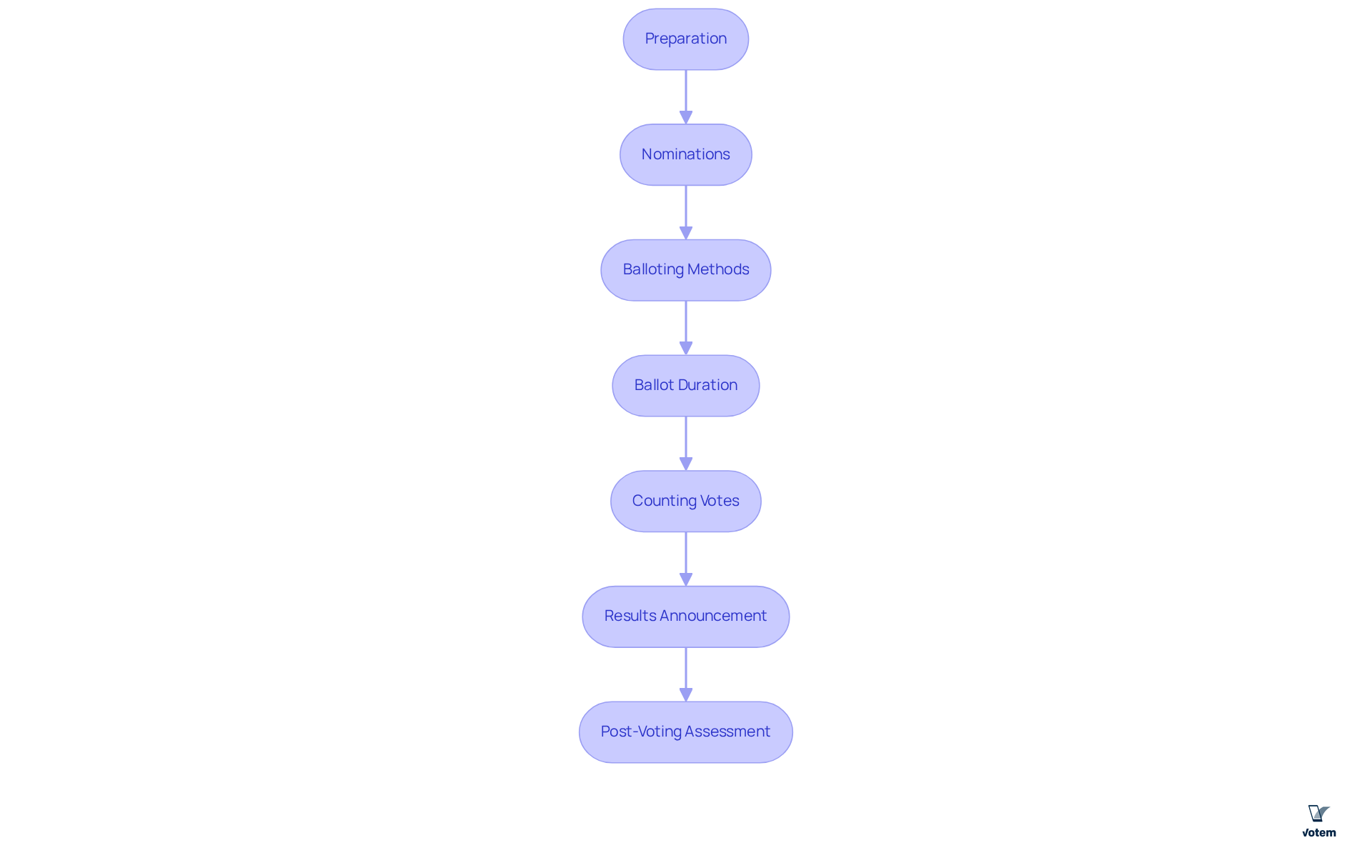

Navigate the Election Process in Credit Unions

The election process in credit unions is meticulously structured to uphold fairness and transparency, comprising several essential steps:

- Preparation: The board of directors or a designated nominating committee initiates the election by reviewing bylaws and determining the number of available positions.

- Nominations: Individuals are encouraged to nominate candidates for the board, either through a formal nomination process or by petition, which requires at least 100 signatures from fellow participants.

- Balloting Methods: Credit unions typically provide various balloting options, such as in-person, mail-in, and electronic participation. Votem’s groundbreaking enhance accessibility and security, ensuring that all participants, including individuals with disabilities and military voters, can engage effectively. Clear communication of these options is vital to ensure all participants are informed. As Linda McCulloch stated, “Implementing Votem’s new, modern system which allowed greater access for all qualified voters from military voters to voters with disabilities was my greatest accomplishment in office.”

- Ballot Duration: A specific ballot duration is established, allowing ample time for members to participate. This duration is crucial for maximizing turnout, with mobile-first platforms capable of boosting participation by up to three times on launch day.

- Counting Votes: After the voting period concludes, votes are tallied, frequently by a neutral party to ensure fairness and integrity in the procedure. Votem’s commitment to openness and verifiability in voting supports trustworthy electoral systems, as emphasized by the New Mexico State Republican Party’s satisfaction with Votem’s software.

- Results Announcement: Election results are announced to the membership, typically during the annual meeting, reinforcing transparency and trust in the electoral process. Votem’s systems have effectively managed substantial vote tallies, showcasing their ability to oversee large-scale voting processes efficiently. For instance, Votem assisted in delivering 123,000 votes, more than double the turnout of the previous poll in 2015.

- Post-Voting Assessment: Conducting a review of the voting process helps identify strengths and areas for improvement, ensuring that future contests are even more effective.

As credit unions like Members First Credit Union of Florida prepare for their yearly credit union elections, the emphasis on transparency and adherence to regulations such as NCUA and DOL is essential. The implementation of secure online voting systems, such as Votem’s CastIron, not only enhances accessibility but also builds voter confidence, rendering contested contests uncommon. By adhering to these best practices, credit unions can ensure a smooth and successful voting procedure.

Implement Strategies to Boost Voter Participation

Boosting voter involvement in credit union elections is essential for nurturing a strong democratic system. To enhance engagement, consider the following strategies:

- Effective Communication: Utilize various mediums like email, social media, and newsletters to keep individuals updated about the voting system, contenders, and the importance of their votes. This multi-faceted strategy ensures that information reaches individuals where they are most engaged.

- Informational Initiatives: Arrange educational sessions or webinars to inform participants about the electoral system and the duties of elected officials. Such initiatives can clarify the electoral process and enable individuals to make informed decisions.

- Incentives: Implement rewards for cast ballots, such as entry into raffles or discounts on services, to motivate participation. These rewards can generate enthusiasm for the election and encourage active engagement.

- Simplified Balloting: Ensure the election process is user-friendly and accessible, particularly through mobile-friendly online balloting options. A mobile-first user experience can enhance turnout by as much as three times on launch day, facilitating participation from any location. Votem’s enhance accessibility, allowing greater participation from all qualified electors, including those with disabilities.

- Engagement with Younger Individuals: Customize outreach initiatives for younger individuals via focused social media campaigns and events that align with their interests. Involving this demographic is essential for fostering a sustainable participation culture within the credit union.

- Feedback Mechanisms: After the polls, collect input from participants about their experiences to pinpoint areas for enhancement. This practice not only improves future voting processes but also shows a dedication to member satisfaction and ongoing enhancement. As emphasized by Votem, making voting simple, enjoyable, and inclusive can greatly boost voter involvement in credit union elections, as shown by their success in managing 299,000 votes for the National Radio Hall of Fame, marking a considerable rise from prior years.

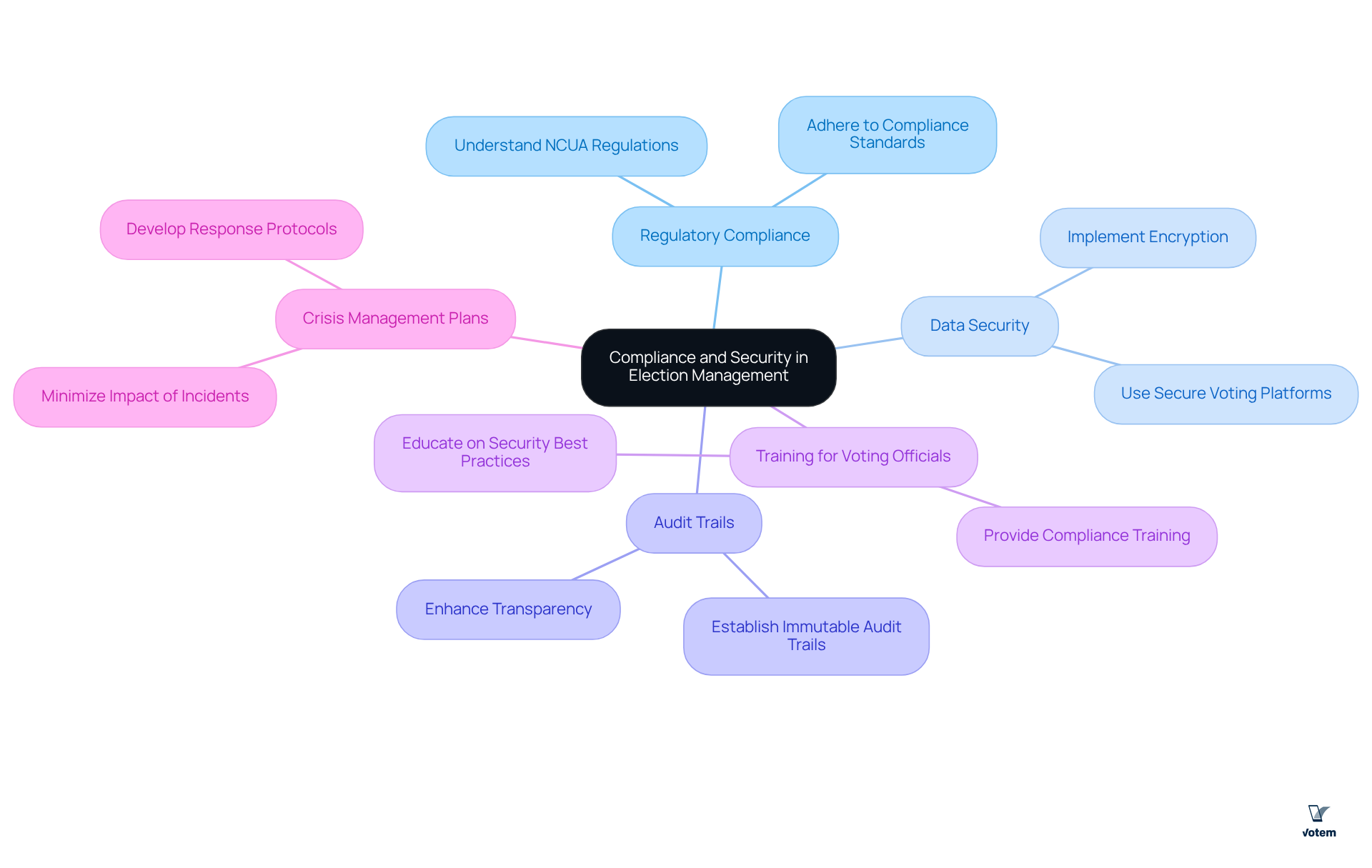

Ensure Compliance and Security in Election Management

Compliance and security are paramount in managing credit union elections. To effectively navigate this landscape, consider the following essential strategies:

- Regulatory Compliance: It is crucial to understand and adhere to the regulations established by the NCUA and other governing bodies. This ensures that all procedures related to credit union elections meet the necessary compliance standards.

- Data Security: Employ advanced security measures, such as encryption and secure voting platforms, to safeguard voter data. This is vital for upholding trust in the electoral system, especially as credit unions face increasing cyber threats.

- Audit Trails: Establish clear and immutable audit trails throughout the voting process, from nominations to vote counting. This enhances transparency and accountability in the context of credit union elections, satisfying compliance requirements while assuring members of the integrity of the voting process.

- Training for Voting Officials: Provide thorough instruction for voting officials on compliance standards and security best practices. This guarantees that all staff engaged in the voting procedure are well-prepared to maintain standards and address potential concerns effectively.

- Crisis Management Plans: Formulate robust plans to address potential security breaches or compliance challenges. Having established protocols allows for swift and effective responses, minimizing the impact of any incidents on the electoral process.

By prioritizing these strategies, credit union elections can be significantly enhanced in security and better protect sensitive voter information. Ultimately, this fosters among members.

Conclusion

Understanding credit union elections is essential for fostering a democratic governance structure that empowers members. By engaging in the election process, individuals contribute to the collective decision-making that shapes the future of their credit unions. This cooperative model not only emphasizes member ownership but also enhances accountability and transparency, ensuring that every voice is heard.

The article highlights fundamental aspects of credit union elections, including the structured election process, strategies for boosting voter participation, and the importance of compliance and security. Key strategies such as effective communication, educational initiatives, and simplified balloting methods are crucial for enhancing voter engagement. Furthermore, prioritizing compliance with regulations and implementing robust security measures helps to build trust and integrity in the electoral process.

In conclusion, active participation in credit union elections is vital for ensuring that the governance reflects the members’ interests. By adopting best practices and innovative strategies, credit unions can enhance voter turnout and create a more engaged community. Embracing these principles not only strengthens the democratic process but also reinforces the significance of member involvement in shaping the credit union landscape.

Frequently Asked Questions

What is the purpose of credit union elections?

Credit union elections empower participants to choose representatives who advocate for their interests, playing a vital role in governance.

How do credit unions differ from conventional banks in terms of governance?

Credit unions operate under a cooperative model, meaning every participant has a voice in decision-making processes, unlike conventional banks.

How often do credit union elections occur?

Credit union elections typically occur annually.

What governs the procedures for credit union elections?

Specific bylaws govern the procedures for nominations, voting, and announcing results in credit union elections.

Why is member ownership important in credit unions?

Member ownership fosters a sense of community and shared responsibility among participants.

How are credit union elections conducted to ensure transparency and accountability?

Credit union elections are conducted democratically to ensure that leadership reflects the will of the members, enhancing transparency and accountability.

What technology does Votem use for credit union elections?

Votem employs cutting-edge online ballot systems to streamline the electoral process, ensuring security and accessibility for every voter.

How has Votem improved voter engagement?

Votem’s commitment to improving accessibility has led to increased voter engagement, particularly among military voters and individuals with disabilities.

What recent announcement was made regarding the Board of Directors?

Nominations for the 2025 Board of Directors are now open, emphasizing the ongoing commitment to stakeholder engagement and democratic governance.

What feedback has been received regarding Votem’s effectiveness?

Testimonials from satisfied clients highlight Votem’s effectiveness in enhancing voter turnout and maintaining voting integrity.

List of Sources

- Explore the Fundamentals of Credit Union Elections

- News From The 2025 Annual Meeting – Corda Credit Union (https://cordacu.org/blog/news-from-the-2025-annual-meeting)

- News & Media (https://americascreditunions.org/news-media)

- 2025 Credit Union Election (https://firefightersfirstcu.org/About/About-Us/News-Events/2025-Credit-Union-Election)

- Spectra Credit Union (https://spectracu.com/news-events-articles/2025-nominees-for-board-of-directors)

- Navigate the Election Process in Credit Unions

- FHLBank Atlanta Opens 2025 Director Election Process – MD|DC Credit Union Association (https://mddccua.org/2025/07/fhlbank-atlanta-opens-2025-director-election-process)

- Xtend’s 2025 Call to Nominations Have Been Mailed to Your Credit Union | CU*Answers (https://cuanswers.com/2025/02/xtends-2025-call-to-nominations-have-been-mailed-to-your-credit-union)

- elections – Members First CU of Florida (https://membersfirstfl.org/elections)

- Spectra Credit Union (https://spectracu.com/news-events-articles/2025-nominees-for-board-of-directors)

- Merger Updates – Ukrainian Selfreliance Federal Credit Union (https://ukrfcu.com/merger-updates)

- Implement Strategies to Boost Voter Participation

- Don’t Forget: Today Is Election Day for Credit Unions Too! (https://cusomag.com/2024/11/05/dont-forget-today-is-election-day-for-credit-unions-too)

- Increase Voter Turnout: 5 Ways That Increase Voting Participation (https://electionbuddy.com/5-ways-to-increase-voter-turnout-in-elections)

- CrossState president/CEO says effective communication is key to credit union success (https://americascreditunions.org/news-media/news/crossstate-presidentceo-says-effective-communication-key-credit-union-success)

- Twin Pines Voter Project – NCBA CLUSA (https://ncbaclusa.coop/vote)

- Credit Union Election Marketing: How to Get It Right (https://surveyandballotsystems.com/blog/credit-unions/promote-credit-union-election)

- Ensure Compliance and Security in Election Management

- The Top Compliance Challenges in 2025 and how to succeed (https://comply-yes.com/blog/the-top-compliance-challenges-facing-credit-unions-in-2025-and-how-to-overcome-them)

- 2025 Regulatory Compliance Updates (https://oncourselearning.com/resources/2025-regulatory-compliance-updates-for-banks-and-credit-unions)

- ncua.gov (https://ncua.gov/regulation-supervision/letters-credit-unions-other-guidance/ncuas-2025-supervisory-priorities)

- Boosted Cybersecurity for Credit Unions (https://surveyandballotsystems.com/blog/credit-unions/credit-union-elections-bank-level-security)

- Here’s Why Credit Unions Must Take Data Privacy Seriously in 2025 (https://cutimes.com/2025/07/11/heres-why-credit-unions-must-take-data-privacy-seriously-in-2025)