Overview

This article highlights the critical role of union leaders in mastering the Houston Municipal Employees Pension System to advocate effectively for their members’ retirement benefits. By delving into essential components such as eligibility criteria, funding sources, and the regulatory framework, it underscores the necessity of understanding these elements. This knowledge is crucial for union leaders, enabling them to represent their members effectively and negotiate favorable retirement advantages. Furthermore, by grasping the intricacies of the pension system, union leaders can enhance their advocacy efforts and ensure that their members receive the benefits they deserve.

Introduction

Understanding the intricacies of the Houston Municipal Employees Pension System (HMEPS) is crucial for union leaders seeking to secure optimal retirement outcomes for their members. This system encompasses a framework that includes eligibility criteria, compensation structures, and regulatory compliance, presenting a wealth of opportunities for effective advocacy and negotiation. However, as recent updates reveal, navigating the complexities of pension management presents significant challenges.

How can union leaders leverage their roles not only to grasp these fundamentals but also to champion their members’ financial security in an ever-evolving landscape?

By delving deeper into HMEPS, union leaders can uncover strategies that not only enhance their understanding but also empower them to advocate more effectively. The landscape of pension management is fraught with complexities, yet it is precisely within these challenges that opportunities for impactful leadership arise. As union leaders engage with these intricacies, they position themselves as champions of their members’ financial well-being, ready to tackle the evolving demands of retirement security.

Explore the Fundamentals of the Houston Municipal Employees Pension System

The Houston Municipal Employees Pension System is designed to provide retirement rewards to qualified city employees, operating under specific rules that govern contributions, benefits, and eligibility. Understanding the key components is crucial for effective leadership.

Eligibility Criteria: It is essential to grasp who qualifies for benefits. Typically, employees must meet certain age and service requirements, ensuring that the right individuals are supported in their retirement journey.

Compensation Structure: HMEPS offers defined advantages based on years of service and salary. Union leaders must communicate these benefits clearly to members, fostering a comprehensive understanding of the available.

Funding Sources: The retirement plan is financed through employee contributions, employer contributions, and investment returns. Leaders should be acutely aware of how these funds are managed and their impact on future benefits. Notably, the Group D Cash Balance Account interest rate will be 0.21% bi-weekly, effective with the first full bi-weekly pay period after January 1, 2025.

Regulatory Framework: Knowledge of state and federal regulations governing retirement plans, including ERISA, is vital for compliance and advocacy efforts. It is also significant to note that the Houston Municipal Employees Pension System operates independently from the City of Houston, which does not manage the retirement system but provides special incentives to eligible retirees.

By mastering these fundamentals, union leaders can effectively advocate for their members, ensuring the retirement system remains viable and advantageous. Recent updates include:

- A cost of living adjustment (COLA) of 2.0% effective February 1, 2025.

- A Deferred Retirement Option Plan (DROP) interest rate of 5.44% for the calendar year 2025, reflecting the Board’s commitment to preserving robust retirement advantages.

- Recent trustee elections resulted in:

- Lenard Polk being elected to Active Employee Trustee Position 3

- Rhonda Smith to Active Employee Trustee Position 4

- Lonnie Vara to Retiree Trustee Position 7

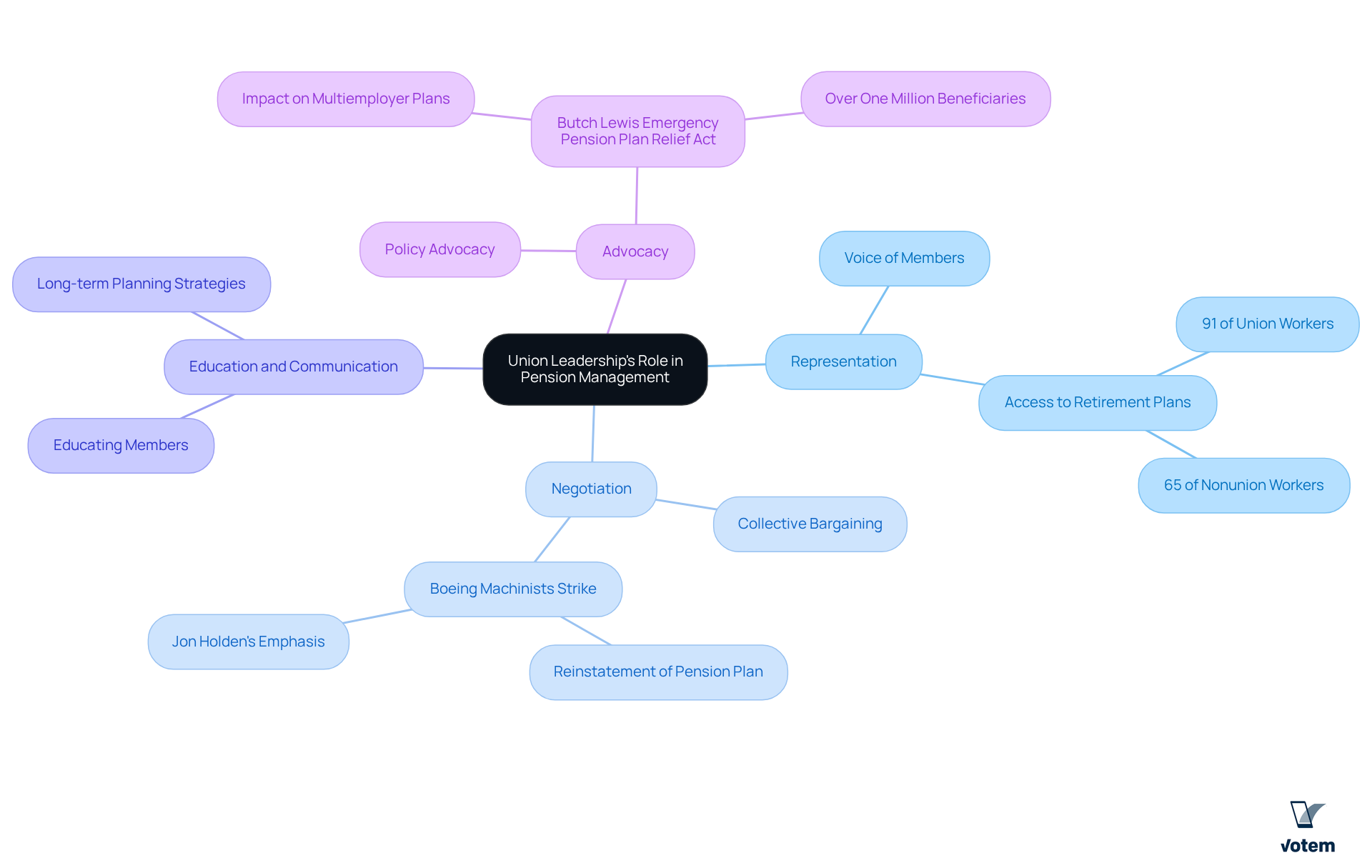

Define Union Leadership’s Role in Pension Management and Negotiations

Union leaders play a crucial role in negotiating retirement advantages for their constituents. Their responsibilities encompass several key areas that significantly impact the financial security of their members.

- Representation: Acting as the voice of the members, union leaders must ensure that the concerns and needs of employees are represented in pension discussions. This representation is vital, especially when considering that 91% of union employees have access to retirement plans compared to just 65% of nonunion employees. Such statistics underscore the importance of union representation in securing retirement benefits.

- Negotiation: Leaders are often deeply involved in discussions surrounding retirement benefits during collective bargaining agreements. Understanding the is essential for successful negotiation. This is particularly evident in the ongoing Boeing machinists strike, where the reinstatement of a conventional retirement plan remains a significant hurdle. Jon Holden, president of the International Association of Machinists and Aerospace Workers, has emphasized that the loss of retirement benefits is central to the workers’ grievances.

- Education and Communication: It is imperative for union leaders to educate members about their retirement advantages, including strategies for optimizing these benefits and the importance of long-term planning. Effective communication empowers members to make informed decisions regarding their retirement, ultimately enhancing their financial well-being.

- Advocacy: Leaders must advocate for policies that protect and enhance retirement benefits, ensuring that the system remains viable and responsive to the evolving needs of employees. Effective advocacy initiatives, such as the incorporation of the Butch Lewis Emergency Retirement Plan Relief Act into the American Rescue Plan, illustrate the power of organized labor in securing retirement protections for over one million beneficiaries. Karen Friedman from the Pension Rights Center has noted an increasing desire for reliable retirement plans, indicating a shift in employees’ expectations.

By clearly defining these roles, union leaders can significantly enhance their effectiveness in managing pension-related issues and advocating for their members’ financial security.

Implement Strategies for Effective Pension Advocacy and Management

To effectively advocate for and manage pension benefits, union leaders must implement several key strategies:

- Data-Driven Advocacy: Leveraging data and analytics is crucial for assessing the financial health of the pension system. This approach enables informed advocacy for necessary reforms based on solid evidence. The retirement funds landscape, valued at £2 trillion, underscores the importance of effective management in this sector.

- Engagement with Participants: Cultivating open lines of communication with union participants regarding retirement issues fosters an environment that encourages feedback and active participation in discussions. Successful can significantly enhance advocacy efforts, ensuring that the voices of union members are heard and considered.

- Collaboration with Experts: Forming partnerships with financial advisors and retirement specialists provides access to insights into best practices and emerging trends in retirement management. This collaboration ensures that advocacy efforts are well-informed. As Tim Hill emphasizes, retirement fund decisions should focus exclusively on maximizing returns for beneficiaries, highlighting the necessity for expert guidance.

- Legislative Advocacy: Staying informed about legislative changes that could impact retirement benefits is essential. Union leaders must actively participate in advocacy to shape policy decisions that reflect the interests of their constituents. For instance, NCPERS is currently opposing H.R. 4015, which threatens access to independent corporate governance research for public retirement benefits.

- Training and Development: Providing training sessions for labor leaders and participants on retirement fund management equips them with the knowledge and skills necessary to navigate the complexities of the system effectively. This investment in education empowers union leaders and members alike.

By adopting these strategies, union leaders can significantly enhance their effectiveness in managing pension benefits and advocating for the rights of their members.

Conclusion

Mastering the Houston Municipal Employees Pension System is essential for union leaders seeking to secure optimal retirement benefits for their members. By grasping the intricacies of eligibility, compensation structures, funding sources, and regulatory frameworks, leaders can effectively advocate for their constituents, ensuring their financial security in retirement.

Union leaders play crucial roles in managing pension benefits, encompassing:

- Representation

- Negotiation

- Education

- Advocacy

These responsibilities are particularly vital in an environment where union employees enjoy significantly better access to retirement plans than their nonunion counterparts. Furthermore, the importance of strategic approaches—including:

- Data-driven advocacy

- Participant engagement

- Collaboration with experts

- Legislative advocacy

- Training

cannot be overstated. These strategies empower leaders to navigate the complexities of pension management and champion their members’ rights effectively.

The significance of understanding and advocating for the Houston Municipal Employees Pension System is paramount. As the landscape of retirement benefits continues to evolve, union leaders must remain vigilant and proactive in their efforts. By prioritizing education and effective communication, they can ensure that their members are well-informed and prepared to maximize their retirement options. Engaging in these practices not only enhances the viability of the pension system but also strengthens the overall financial well-being of union members, fostering a secure future for all.

Frequently Asked Questions

What is the purpose of the Houston Municipal Employees Pension System (HMEPS)?

The HMEPS is designed to provide retirement rewards to qualified city employees, operating under specific rules that govern contributions, benefits, and eligibility.

What are the eligibility criteria for HMEPS benefits?

Employees must meet certain age and service requirements to qualify for benefits, ensuring that the right individuals are supported in their retirement journey.

How is the compensation structure determined in HMEPS?

HMEPS offers defined advantages based on years of service and salary, and it is important for union leaders to communicate these benefits clearly to members.

What are the funding sources for the HMEPS?

The retirement plan is financed through employee contributions, employer contributions, and investment returns.

What is the interest rate for the Group D Cash Balance Account effective January 1, 2025?

The interest rate will be 0.21% bi-weekly, effective with the first full bi-weekly pay period after January 1, 2025.

Why is it important to understand the regulatory framework of HMEPS?

Knowledge of state and federal regulations governing retirement plans, including ERISA, is vital for compliance and advocacy efforts.

Does the City of Houston manage the HMEPS?

No, the Houston Municipal Employees Pension System operates independently from the City of Houston, which does not manage the retirement system but provides special incentives to eligible retirees.

What recent updates have been made to the HMEPS?

Recent updates include a cost of living adjustment (COLA) of 2.0% effective February 1, 2025, and a Deferred Retirement Option Plan (DROP) interest rate of 5.44% for the calendar year 2025.

Who were the recent trustee elections for HMEPS?

Lenard Polk was elected to Active Employee Trustee Position 3, Rhonda Smith to Active Employee Trustee Position 4, and Lonnie Vara to Retiree Trustee Position 7.

List of Sources

- Explore the Fundamentals of the Houston Municipal Employees Pension System

- News and Updates (https://hmeps.org/news-and-updates)

- 35 Retirement Quotes for a Happy, Healthy, and Wealthy Life (https://ruleoneinvesting.com/blog/personal-development/retirement-quotes)

- Define Union Leadership’s Role in Pension Management and Negotiations

- At the heart of the Boeing strike, an emotional fight over a lost pension plan (https://npr.org/2024/10/28/nx-s1-5163629/boeing-pension-strike-machinists-union)

- Case Studies | RCLCO Real Estate Consulting (https://rclco2024.lvdev.net/resources/case_studies)

- Unions Fight for That: Pension and Retirement Benefits for Workers (https://uniontrack.com/blog/unions-retirement-benefits)

- Economically Targeted Investments, Union Pension Funds, and Public–Private Partnerships in Canada | Pensions at Work (https://utppublishing.com/doi/10.3138/9781487524937.007)

- Steps for Effectively Addressing State and Local Pension Crises (https://rand.org/pubs/research_briefs/RBA2307-1.html)

- Implement Strategies for Effective Pension Advocacy and Management

- TPR data strategy: Transforming our data for better saver outcomes | The Pensions Regulator (https://thepensionsregulator.gov.uk/en/document-library/corporate-information/tpr-data-strategy)

- BLOG: NCPERS: The Voice for Public Pensions (https://ncpers.org/blog_home.asp?display=303)

- NCPERS Advocacy Activities | Public Pension Policy Issues (https://ncpers.org/advocacy-activities)