Overview

To master credit union cybersecurity compliance, organizations must grasp regulatory requirements, implement essential cybersecurity practices, and establish continuous monitoring protocols. Compliance is not merely a checkbox; it involves adhering to NCUA regulations, conducting regular risk assessments, and developing incident response plans. These actions collectively fortify defenses against cyber threats and ensure the protection of member data.

Furthermore, understanding the nuances of compliance can significantly enhance an organization’s resilience against potential breaches. By proactively addressing vulnerabilities, credit unions can not only safeguard their operations but also build trust with their members. This trust is paramount in today’s digital landscape, where data security is a top concern for consumers.

In addition, continuous monitoring is crucial. It allows organizations to detect and respond to threats in real-time, minimizing the risk of data loss or reputational damage. By establishing robust monitoring protocols, credit unions can stay ahead of emerging cyber threats, ensuring that they are always prepared to protect their members’ information.

Ultimately, the commitment to cybersecurity compliance is a strategic imperative for credit unions. It not only safeguards sensitive data but also reinforces the organization’s credibility and reliability in the eyes of its members. Union leadership must prioritize these practices to foster a secure environment for all stakeholders.

Introduction

In an era marked by increasingly sophisticated cyber threats, credit unions are under significant pressure to adhere to stringent cybersecurity regulations. Understanding the specific compliance requirements established by regulatory bodies transcends mere legal obligation; it is a critical strategy for safeguarding member data and preserving trust. How can credit unions navigate this intricate landscape and implement robust cybersecurity measures that not only fulfill compliance standards but also shield their operations from potential breaches? This guide delineates three essential steps to master cybersecurity compliance, equipping credit unions with the necessary tools to strengthen their defenses against ever-evolving cyber risks.

Understand Cybersecurity Compliance Requirements for Credit Unions

To effectively navigate credit union cyber security compliance, financial cooperatives must thoroughly comprehend the specific requirements set by regulatory agencies such as the National Credit Administration (NCUA). Key regulations include:

-

NCUA 12 CFR Part 748: This regulation mandates that credit unions implement a comprehensive written cybersecurity program that encompasses risk assessments, incident response protocols, and robust member data protection measures. Significantly, the NCUA has expanded the definition of ‘sensitive data,’ which is essential for credit organizations to understand the complete extent of their obligations.

-

Cyber Incident Notification Requirements: Credit cooperatives are obligated to report significant cyber incidents to the NCUA within 72 hours of discovery, particularly those that could jeopardize member data or financial stability. This new rule, effective since September 1, 2023, underscores the urgency of timely reporting in maintaining member trust and regulatory compliance. In 2022, there were over 800,000 cyber attacks in the US alone, emphasizing the urgent requirement for strong protective measures.

-

NIST Cybersecurity Framework: Adopting this framework allows financial cooperatives to align their cybersecurity practices with established industry standards, thereby strengthening their defenses against evolving cyber threats. Grasping and applying the NIST framework is essential for financial cooperatives to improve their protective stance and guarantee adherence to regulatory demands. As Alexander D. Boyd highlights, “Every federally-insured financial cooperative should guarantee its incident response plan and documented information protection policies align with the new regulation.”

By understanding these requirements and acknowledging that 31% of organizations indicated experiencing a data breach, financial cooperatives can proactively enhance their security strategies to achieve credit union cyber security compliance, ultimately protecting their members’ interests. Furthermore, organizations should investigate proactive measures for protection and privacy to reduce the risk of becoming a target of an incident.

Implement Essential Cybersecurity Best Practices

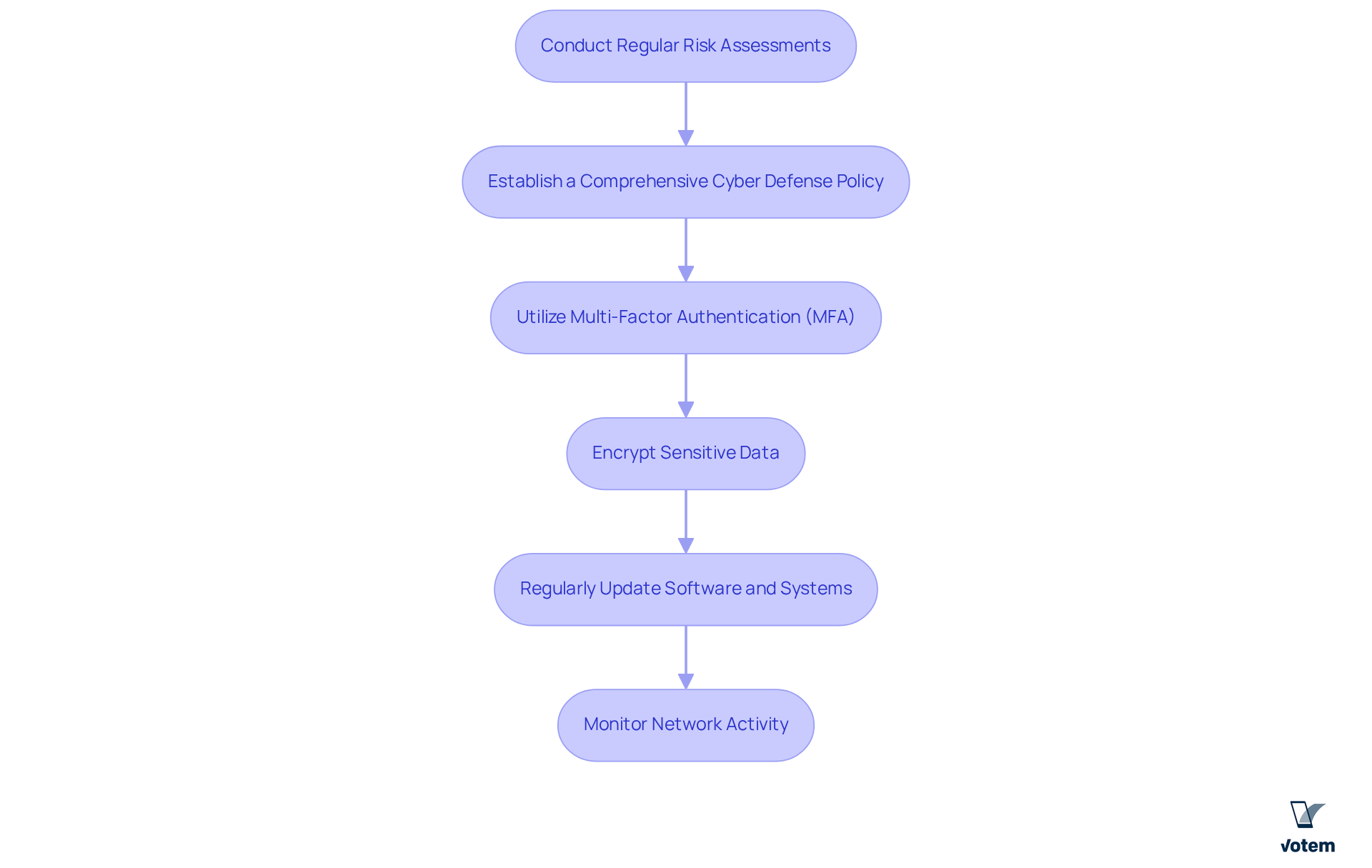

To effectively implement cybersecurity best practices, credit unions must prioritize the following steps:

-

Conduct Regular Risk Assessments: It is essential to identify vulnerabilities within your systems and prioritize them based on potential impact. This process should occur at least annually or whenever significant changes arise, as regular assessments are crucial for adapting to evolving threats.

-

Establish a Comprehensive Cyber Defense Policy: Develop a robust policy that outlines protective protocols, employee responsibilities, and incident response procedures. Ensure that all staff are trained on this policy to cultivate a culture of awareness regarding safety.

-

Utilize Multi-Factor Authentication (MFA): Implement MFA for all systems accessing sensitive data to provide an additional layer of protection against unauthorized access. Notably, MFA can block 99.9% of automated attacks, significantly reducing the risk of breaches caused by compromised passwords, which accounted for over 80% of data breaches in 2022.

-

Encrypt Sensitive Data: Employ strong encryption methods for data at rest and in transit to safeguard member information from breaches. This practice is vital for maintaining compliance with regulatory requirements and protecting sensitive information.

-

Regularly Update Software and Systems: Ensure that all software, including security tools, is consistently updated to protect against known vulnerabilities. Keeping systems current is a fundamental aspect of a robust cybersecurity strategy.

-

Monitor Network Activity: Utilize intrusion detection systems to monitor for unusual activity that may indicate a cyber threat. Proactive monitoring can help identify and mitigate potential risks before they escalate.

By adhering to these best practices, financial cooperatives can significantly reduce their risk of cyber incidents and improve their credit union cyber security compliance, ultimately fostering greater trust among members.

Establish Continuous Monitoring and Risk Management Protocols

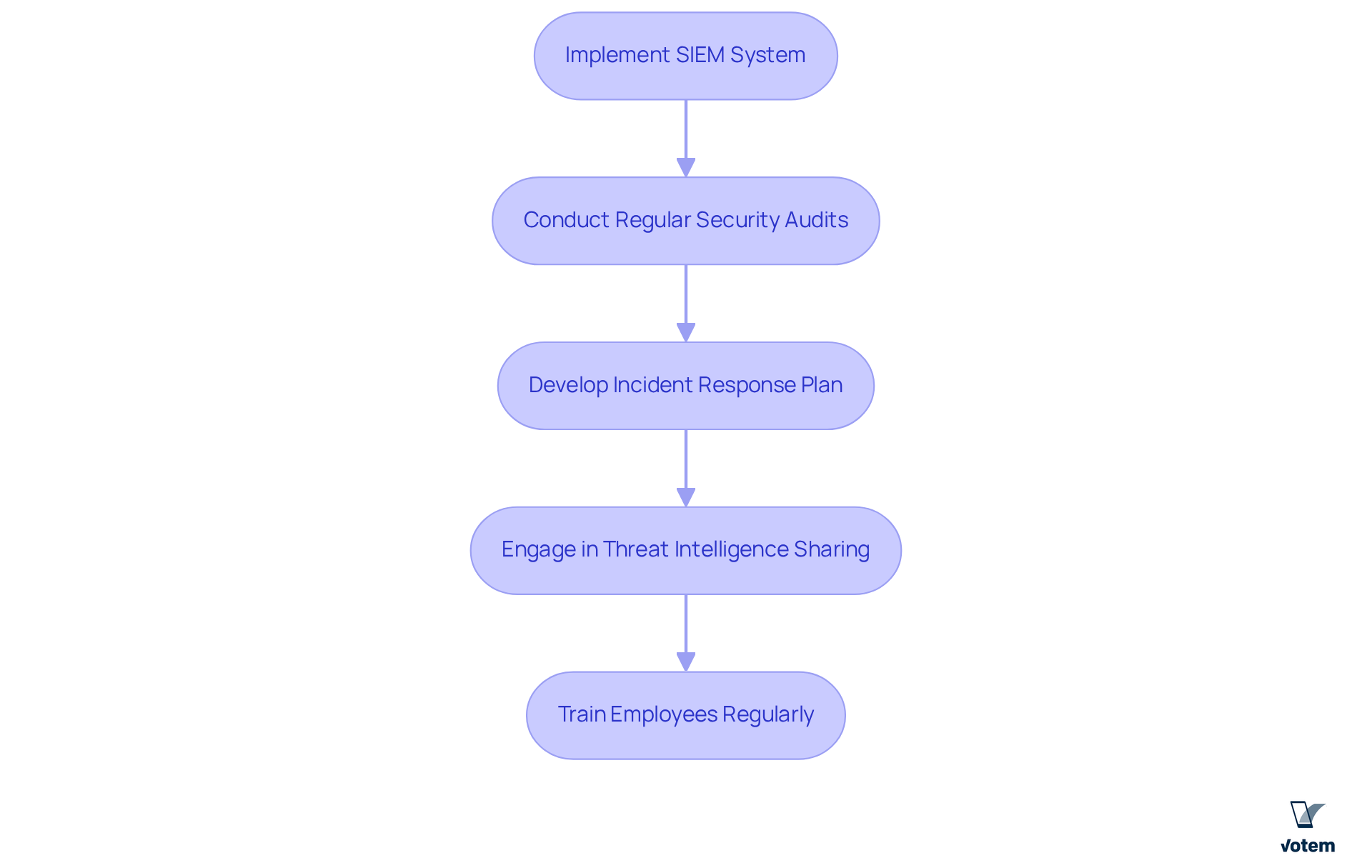

To establish effective continuous monitoring and risk management protocols, credit unions must take decisive action:

-

Implement a Security Information and Event Management (SIEM) System: A SIEM system is essential for gathering and analyzing safety-related data across the organization, providing real-time alerts for suspicious activities. This proactive measure is crucial, especially considering that 31% of organizations reported experiencing a data breach, and 75% of professionals noted a rise in attacks over the past 12 months. These statistics underscore the necessity for robust defenses.

-

Conduct Regular Security Audits: It is imperative to schedule both internal and external audits to evaluate the effectiveness of your cybersecurity measures and ensure compliance with regulations. These audits not only help identify vulnerabilities but also reinforce trust with stakeholders. Compliance with standards like PCI DSS is vital for ensuring credit union cyber security compliance and protecting customer data. Almost two-thirds of safety leaders agree that traditional training methods are ineffective in ensuring cyber resilience, making regular audits increasingly essential.

-

Develop an Incident Response Plan: Craft a comprehensive plan detailing the steps to take during a cyber incident, including communication strategies and recovery procedures. This readiness is critical, as organizations that implement proactive measures encounter fewer vulnerabilities.

-

Engage in Threat Intelligence Sharing: Collaborate with other credit unions and industry organizations to share insights on emerging threats and best practices for mitigation. This collective approach enhances overall security posture and fosters a culture of shared responsibility.

-

Train Employees Regularly: Conduct ongoing training sessions to keep staff informed about the latest online security threats and the importance of compliance. Experts emphasize that fostering awareness about online security among staff is vital for sustained protection against emerging dangers. As Mike Laramie noted, “The news of recent breaches will hopefully drive faster adoption of cybersecurity best practices at businesses of all sizes.”

By implementing these protocols, credit unions can maintain a proactive stance against cyber threats while ensuring credit union cyber security compliance with regulatory requirements. Furthermore, it is crucial to recognize that no organization is immune to cyberattacks, highlighting the urgency of these measures.

Conclusion

Mastering cybersecurity compliance is essential for credit unions to protect their members and maintain trust within the financial ecosystem. Understanding the regulatory landscape, implementing best practices, and establishing robust monitoring protocols are crucial steps for credit unions to fortify their defenses against the ever-evolving cyber threats they face.

The article highlights critical components of cybersecurity compliance, including:

- The necessity of adhering to NCUA regulations

- Conducting regular risk assessments

- Fostering a culture of awareness among employees

It emphasizes the importance of using tools like Multi-Factor Authentication and Security Information and Event Management systems to bolster security measures. Furthermore, continuous training and collaboration within the industry are vital for staying ahead of potential threats and ensuring compliance with regulatory standards.

In an age where cyber incidents are becoming increasingly common, credit unions must prioritize their cybersecurity strategies. By taking proactive steps now, financial cooperatives not only safeguard their operations but also enhance member confidence. The time to act is now—investing in comprehensive cybersecurity measures today will pave the way for a secure and compliant future in the financial sector.

Frequently Asked Questions

What are the main cybersecurity compliance requirements for credit unions?

Credit unions must implement a comprehensive written cybersecurity program, conduct risk assessments, establish incident response protocols, and protect member data, as mandated by NCUA 12 CFR Part 748.

What is the significance of the NCUA’s expanded definition of ‘sensitive data’?

The expanded definition of ‘sensitive data’ is crucial for credit organizations to fully understand their obligations regarding data protection and compliance with cybersecurity regulations.

What are the cyber incident notification requirements for credit unions?

Credit unions are required to report significant cyber incidents to the NCUA within 72 hours of discovery, especially those that could threaten member data or financial stability.

When did the new cyber incident notification rule take effect?

The new rule for cyber incident notification took effect on September 1, 2023.

Why is timely reporting of cyber incidents important for credit unions?

Timely reporting is essential for maintaining member trust and ensuring regulatory compliance, especially in light of the high number of cyber attacks in recent years.

How can credit unions strengthen their cybersecurity defenses?

Credit unions can strengthen their defenses by adopting the NIST Cybersecurity Framework, which helps align their cybersecurity practices with established industry standards.

What percentage of organizations reported experiencing a data breach?

31% of organizations indicated that they experienced a data breach.

What proactive measures should credit unions consider to enhance security?

Credit unions should investigate proactive measures for protection and privacy to reduce the risk of becoming targets of cyber incidents.

List of Sources

- Understand Cybersecurity Compliance Requirements for Credit Unions

- Credit Union Security: Your Compliance Roadmap (https://fortra.com/blog/credit-union-security-your-compliance-roadmap)

- 38 Cybersecurity Awareness Month Quotes from Industry Experts in 2023 (https://solutionsreview.com/security-information-event-management/cybersecurity-awareness-month-quotes-from-industry-experts)

- 25+ Best Cybersecurity Quotes (https://atera.com/blog/best-cybersecurity-quotes)

- One moment, please… (https://digitaldefynd.com/IQ/inspirational-cybersecurity-quotes)

- National Credit Union Administration Finalizes 72-Hour Cyber Incident Reporting Rule (https://polsinelli.com/publications/national-credit-union-administration-finalizes-72-hour-cyber-incident-reporting-rule)

- Implement Essential Cybersecurity Best Practices

- The Multifaceted Benefits of Multi-Factor Authentication (https://supertokens.com/blog/benefits-of-multi-factor-authentication)

- 25+ Best Cybersecurity Quotes (https://atera.com/blog/best-cybersecurity-quotes)

- eftsure.com (https://eftsure.com/statistics/two-factor-authentication-statistics)

- One moment, please… (https://digitaldefynd.com/IQ/inspirational-cybersecurity-quotes)

- 29 Cybersecurity Quotes That Will Help You Take IT Security Seriously (https://acecloudhosting.com/blog/cybersecurity-quotes)

- Establish Continuous Monitoring and Risk Management Protocols

- 25+ Best Cybersecurity Quotes (https://atera.com/blog/best-cybersecurity-quotes)

- One moment, please… (https://digitaldefynd.com/IQ/inspirational-cybersecurity-quotes)

- 38 Cybersecurity Awareness Month Quotes from Industry Experts in 2023 (https://solutionsreview.com/security-information-event-management/cybersecurity-awareness-month-quotes-from-industry-experts)

- 51 Powerful Cybersecurity Quotes to Protect Your Business (https://cyburanus.com/blog/51-powerful-cybersecurity-quotes)

- 29 Cybersecurity Quotes That Will Help You Take IT Security Seriously (https://acecloudhosting.com/blog/cybersecurity-quotes)