Overview

This article outlines four essential marketing strategies that credit unions can employ to effectively engage their members. It emphasizes the critical need for:

- Understanding the target audience

- Fostering community engagement

- Leveraging digital marketing

- Committing to continuous improvement through performance measurement

Each strategy underscores the importance of tailored communication, building trust through community involvement, utilizing digital tools to enhance member experiences, and applying key performance indicators to adapt and refine marketing efforts. By doing so, credit unions can foster loyalty and satisfaction among their members.

Understanding the target audience is paramount. Credit unions must delve into the demographics and preferences of their members to tailor their communication effectively. This targeted approach not only enhances engagement but also builds a foundation of trust. Furthermore, community engagement plays a vital role in establishing a strong connection with members. By actively participating in local events and initiatives, credit unions can demonstrate their commitment to the community, thereby reinforcing member loyalty.

In addition, digital marketing strategies are indispensable in today’s landscape. Leveraging digital tools allows credit unions to create enhanced member experiences that are both engaging and informative. By utilizing social media, email campaigns, and personalized content, credit unions can reach their members where they are most active. Continuous improvement through performance measurement is the final piece of the puzzle. By utilizing key performance indicators, credit unions can assess the effectiveness of their marketing efforts, enabling them to adapt and refine their strategies. This iterative process not only fosters member satisfaction but also drives sustained loyalty.

In conclusion, by implementing these four marketing strategies—understanding the target audience, engaging with the community, leveraging digital marketing, and committing to continuous improvement—credit unions can effectively enhance member engagement. Union leadership is encouraged to take these insights and apply them to their marketing efforts to achieve greater success.

Introduction

In an increasingly competitive financial landscape, credit unions must engage their members effectively. This pressing need not only enhances member satisfaction but also fosters loyalty and trust within their communities.

By implementing targeted marketing strategies, these institutions can navigate the diverse needs of their audience while adapting to the rapid evolution of digital marketing trends. Furthermore, innovative approaches are essential for credit unions to resonate with their members and thrive in 2025.

What strategies can be adopted to ensure success in this dynamic environment?

Identify and Understand Your Target Audience

To effectively engage individuals, credit unions must prioritize the identification and understanding of their target audience. This process requires a thorough examination of demographic data, participant behavior, and preferences. Utilizing surveys and focus groups offers valuable insights directly from participants. For example, recognizing the age distribution within your group facilitates customized communication approaches; younger individuals often favor digital interaction, while older individuals may respond more effectively to traditional outreach techniques.

Recent statistics reveal that net income for federally insured cooperative associations reached $15.8 billion in the first three quarters of 2024, underscoring the financial landscape in which these organizations operate and the critical importance of effective participant engagement strategies. By segmenting your audience based on these insights, credit unions can craft personalized marketing campaigns that resonate with their interests and needs.

As UnionBank emphasizes, engaging customers through enjoyable experiences is essential for cultivating loyalty. Furthermore, referencing successful case studies, such as the market analysis strategy employed by Spero Financial FCU, illustrates how a deep understanding of demographics can enhance relationships with clients. This targeted strategy not only fosters stronger relationships but also boosts loyalty, ultimately driving engagement and satisfaction.

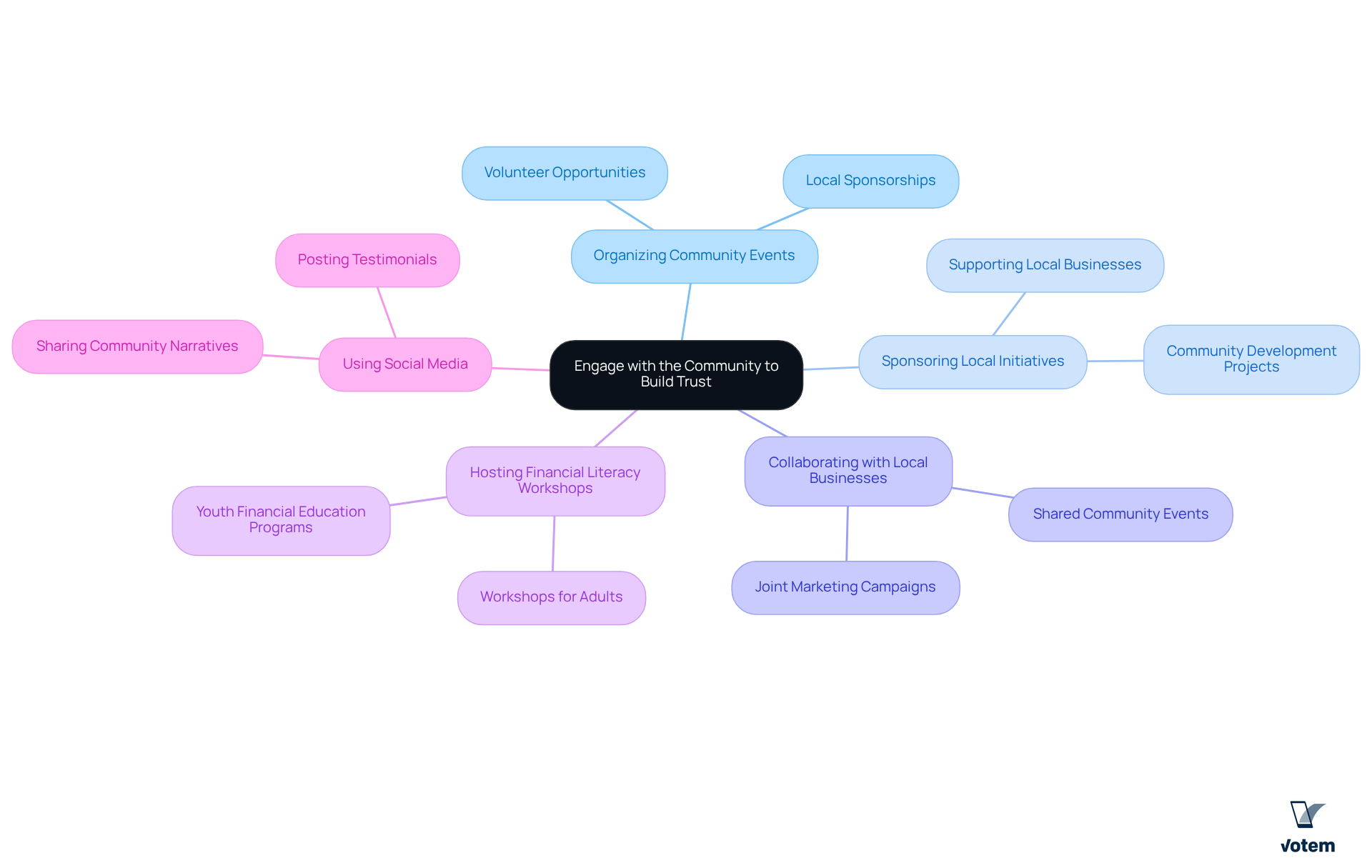

Engage with the Community to Build Trust

Interacting with the community is a vital strategy for financial cooperatives aiming to build trust and strengthen relationships with participants. By organizing community events, sponsoring local initiatives, or collaborating with local businesses, cooperatives not only enhance their visibility but also demonstrate a genuine commitment to the community. For instance, hosting financial literacy workshops provides essential resources to participants, positioning your financial institution as a trusted advisor. Furthermore, transparency in these initiatives fosters trust and accountability among participants.

Utilizing social media platforms to share community narratives and testimonials significantly boosts your financial institution’s reputation, cultivating a sense of belonging and loyalty among individuals. Successful initiatives, such as volunteer opportunities and local sponsorships, have shown a marked improvement in participant retention rates. This underscores the profound impact of community involvement on the success of financial cooperatives. As you consider these strategies, reflect on how your institution can further engage with the community to enhance its role as a reliable partner.

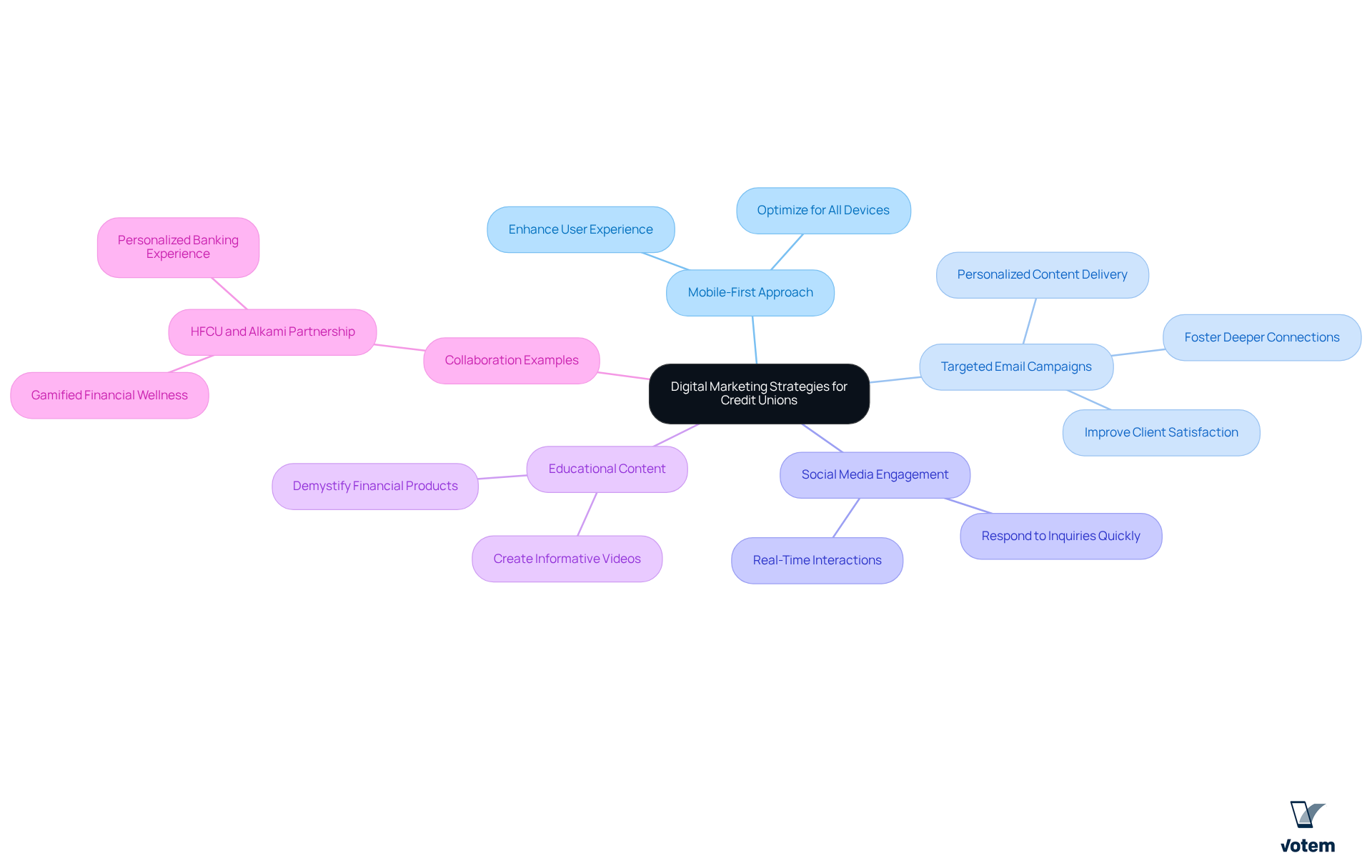

Utilize Digital Marketing Strategies for Enhanced Member Experience

In the digital environment, the implementation of effective marketing for credit unions is essential for enhancing participant experiences within financial cooperatives. A mobile-first approach is not merely an option; it is a necessity, ensuring that your website and communications are optimized for all devices. This is particularly vital as the number of users who prefer mobile banking continues to rise—currently, a striking 89% of Americans engage in mobile banking, and 78% favor digital banking overall.

Targeted email campaigns stand out as a powerful tool, delivering personalized content tailored to user interests and behaviors, thereby fostering deeper connections. Furthermore, leveraging social media platforms enables real-time interactions, allowing credit unions to respond to inquiries with remarkable speed. For instance, the creation of educational video content regarding financial products can demystify complex topics, empowering individuals to make informed decisions.

The collaboration between Hanscom Federal Credit Union and Alkami Technology exemplifies a commitment to innovation in mobile banking, enhancing user engagement through a gamified financial wellness strategy. However, cooperative financial institutions must remain vigilant against common pitfalls associated with a mobile-first approach, such as neglecting user experience or failing to optimize content across various devices.

By prioritizing digital interaction and implementing a mobile-first strategy, marketing for credit unions can significantly elevate client satisfaction and loyalty. This strategic focus not only fosters growth but also positions them competitively in an increasingly challenging market.

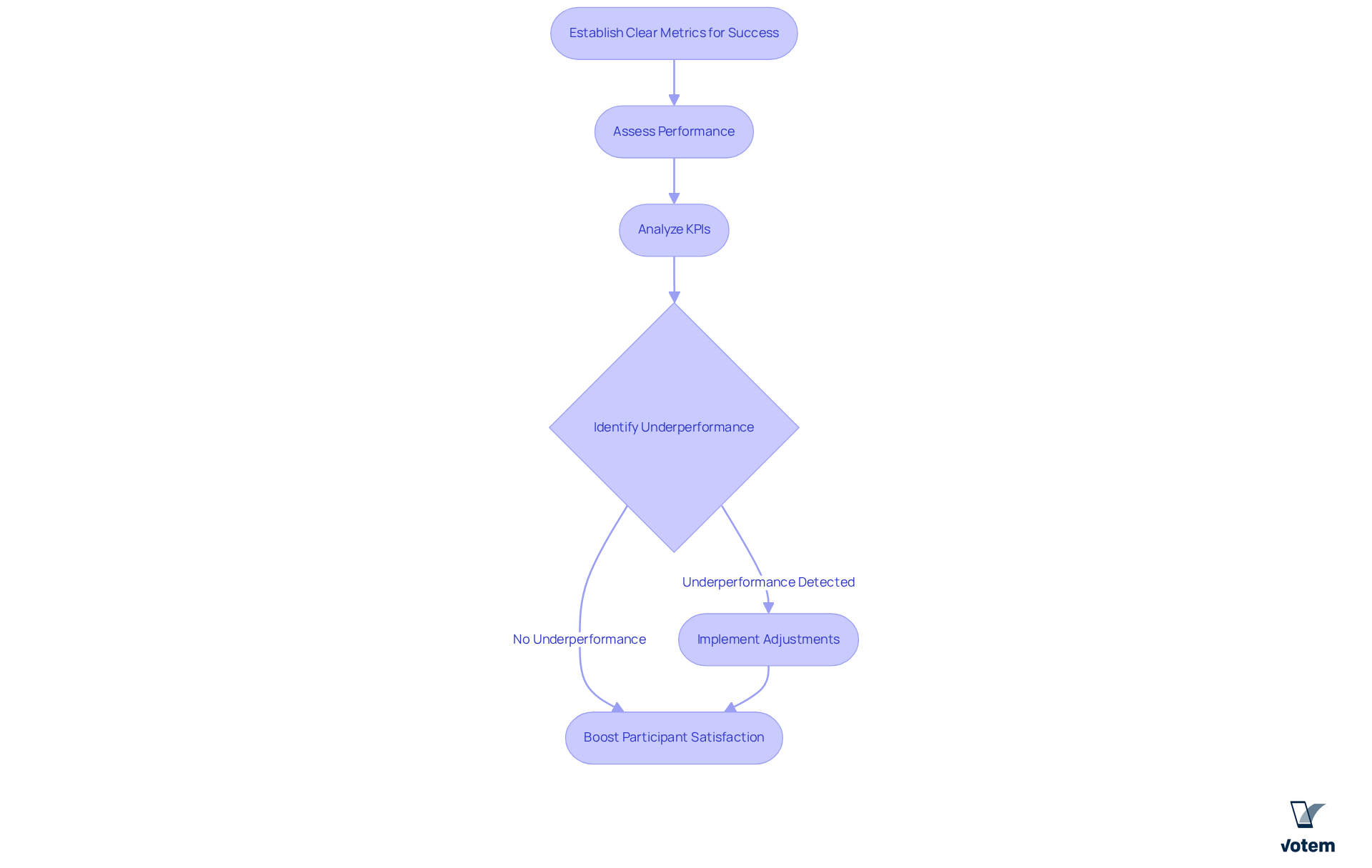

Measure Success and Adapt Strategies for Continuous Improvement

To enhance the effectiveness of marketing for credit unions, financial cooperatives must establish clear metrics for success and consistently assess their performance. Key performance indicators (KPIs) such as participation rates, retention rates, and feedback scores are essential for evaluating the impact of initiatives. In 2025, cooperative financial institutions are anticipated to experience engagement rates significantly influenced by marketing for credit unions through targeted digital strategies. Data indicates that enhanced campaigns can lead to a 30% increase in participant interaction. Furthermore, 90% of CFOs assert that overseeing relationship and customer profitability is crucial, underscoring the vital role of KPIs in marketing for credit unions strategies.

Utilizing tools like Google Analytics provides valuable insights into user behavior on your website, enabling data-driven decision-making. If a specific campaign is underperforming, it is imperative to analyze the underlying reasons and implement necessary adjustments to improve its effectiveness. This iterative process of continuous enhancement not only boosts participant satisfaction but also positions your financial institution for sustained success in a competitive landscape. Additionally, engaging with the community through sponsorships and events can significantly enhance loyalty among individuals, distinguishing cooperative financial institutions from larger banks. By concentrating on the appropriate KPIs and adapting strategies accordingly, credit unions can drive meaningful engagement and cultivate deeper connections with their members through effective marketing for credit unions while navigating the challenges of evolving member needs and asset growth.

Conclusion

Engaging members effectively is paramount for credit unions striving to thrive in a competitive financial landscape. By honing in on the target audience, building community trust, embracing digital marketing strategies, and continuously measuring success, credit unions can create a robust framework for member engagement that fosters loyalty and satisfaction.

The article outlines four essential marketing strategies:

- Understanding demographic insights to tailor communication

- Actively engaging with the community to build trust

- Utilizing digital tools to enhance member experiences

- Implementing metrics for continuous improvement

These strategies not only address the diverse needs of credit union members but also position these institutions as trusted partners in their financial journeys.

Ultimately, the significance of these strategies cannot be overstated. As credit unions navigate the evolving landscape of member expectations, prioritizing personalized engagement and community involvement will be crucial. By adopting these approaches, credit unions can enhance their member relationships and secure their place as vital community resources, ensuring long-term success and relevance in the financial services sector.

Frequently Asked Questions

Why is it important for credit unions to identify and understand their target audience?

Identifying and understanding the target audience is crucial for credit unions to effectively engage individuals, tailor communication approaches, and develop personalized marketing campaigns that resonate with participants’ interests and needs.

What methods can credit unions use to gather insights about their target audience?

Credit unions can utilize surveys and focus groups to gather valuable insights directly from participants, allowing them to examine demographic data, participant behavior, and preferences.

How does the age distribution of the target audience affect communication strategies?

Understanding the age distribution helps credit unions customize their communication approaches; younger individuals often prefer digital interactions, while older individuals may respond better to traditional outreach techniques.

What recent statistics highlight the financial landscape for credit unions?

Recent statistics indicate that net income for federally insured cooperative associations reached $15.8 billion in the first three quarters of 2024, emphasizing the importance of effective participant engagement strategies.

How can audience segmentation benefit credit unions?

By segmenting their audience based on insights gathered, credit unions can craft personalized marketing campaigns that better resonate with their audience’s interests and needs, leading to improved engagement.

What role do enjoyable experiences play in customer engagement for credit unions?

Engaging customers through enjoyable experiences is essential for cultivating loyalty, as emphasized by UnionBank, which helps strengthen relationships and increase overall satisfaction.

Can you provide an example of a successful strategy used by a credit union?

Spero Financial FCU employed a market analysis strategy that illustrates how a deep understanding of demographics can enhance relationships with clients, fostering stronger connections and boosting loyalty.

List of Sources

- Identify and Understand Your Target Audience

- Stats That Support New Branch Builds | CreditUnions.com | Data & Insights For Credit Unions (https://creditunions.com/features/stats-that-support-new-branch-builds)

- Data & statistics (https://americascreditunions.org/data-tools/data-statistics)

- 20 Statistics Every Credit Union Should Know for 2025 (https://blog.flexcutech.com/blog/20-statistics-2025)

- MMA Case Study Hub | Bank the Way You Live by UnionBank (https://mmaglobal.com/case-study-hub/case_studies/view/64190)

- Customer Success Stories | ScreenSteps (https://screensteps.com/case-studies)

- Engage with the Community to Build Trust

- Boost Member Retention: Top 4 Strategies in 2025 (https://interface.ai/blog/boost-member-retention-top-4-strategies)

- BayPort Announces $25,000 Sponsorship Newport News Public Schools’ Office of Youth Development, Family and Community Engagement Division (https://bayportcu.org/news/bayport-announces-25000-sponsorship-newport-news-public-schools-office-of-youth-development-family-and-community-engagement-division)

- Financial Literacy Update: First Quarter 2025 (https://occ.treas.gov/publications-and-resources/publications/community-affairs/financial-literacy-updates/financial-literacy-1st-quarter-2025.html)

- Community Engagement Strategies for Credit Unions (https://inclind.com/solutions/credit-unions/community-engagement)

- MSU Federal Credit Union (https://msufcu.org)

- Utilize Digital Marketing Strategies for Enhanced Member Experience

- icon-alert-warning-filled (https://fidelity.com/news/article/default/202510011000PR_NEWS_USPR_____DA86993)

- Key Online Banking Statistics on Trends & Usage in 2025 (https://moneyzine.com/banking/online-banking-statistics)

- Digital Banking Trends In 2025 | Bankrate (https://bankrate.com/banking/digital-banking-trends-and-statistics)

- 20 Statistics Every Credit Union Should Know for 2025 (https://blog.flexcutech.com/blog/20-statistics-2025)

- S&S Promotional Group, Inc. | Promotional Products & Apparel | Embroidery | Screen Print – Case Studies (https://sspromotionalgroup.com/Case_Studies.htm)

- Measure Success and Adapt Strategies for Continuous Improvement

- The Complete Credit Union Marketing Guide | Evok Advertising (https://evokad.com/complete-credit-union-marketing-guide)

- 10 Key Financial Metrics & KPIs for Banks & Credit Unions | Strata Decision Technology (https://stratadecision.com/blog/10-key-financial-metrics-kpis-banks-credit-unions)

- Think Beyond the Clicks: Bank & Credit Union Marketing Demands Holistic KPI Analysis (https://thefinancialbrand.com/news/digital-marketing-banking/think-beyond-the-clicks-bank-credit-union-marketing-demands-holistic-kpi-analysis-183777)

- 20 Statistics Every Credit Union Should Know for 2025 (https://blog.flexcutech.com/blog/20-statistics-2025)