Overview

The article delineates three pivotal strategies for effective pension fund voting within unions:

- Informing participants

- Developing clear ballot policies

- Enhancing transparency and accountability in voting processes

These strategies are underpinned by compelling evidence that demonstrates how proactive engagement, transparent guidelines, and independent oversight can significantly elevate participant involvement. This, in turn, ensures that their interests are accurately represented in pension fund decisions.

Furthermore, by informing participants, unions can foster a culture of awareness and engagement. Clear ballot policies serve not only to streamline the voting process but also to instill confidence among participants regarding the integrity of their choices. In addition, enhancing transparency and accountability is critical; these elements not only build trust but also empower participants to take an active role in the decision-making process.

In conclusion, implementing these strategies is essential for union leadership seeking to optimize pension fund voting. By prioritizing participant engagement, establishing clear guidelines, and ensuring transparency, unions can effectively represent their members’ interests, thereby reinforcing the credibility and efficacy of their pension fund decisions.

Introduction

Pension fund voting stands at a critical intersection of finance and democratic engagement, especially for union members whose futures depend on these pivotal decisions. Understanding the intricacies of pension fund governance and implementing effective voting strategies can significantly amplify unions’ influence over crucial issues impacting their constituents. However, a pressing challenge persists: how can unions ensure that their members are not only well-informed but also actively participating in the electoral process? This article delves into actionable strategies designed to empower both union leaders and members, fostering a transparent and accountable voting environment that genuinely reflects the collective voice of the workforce.

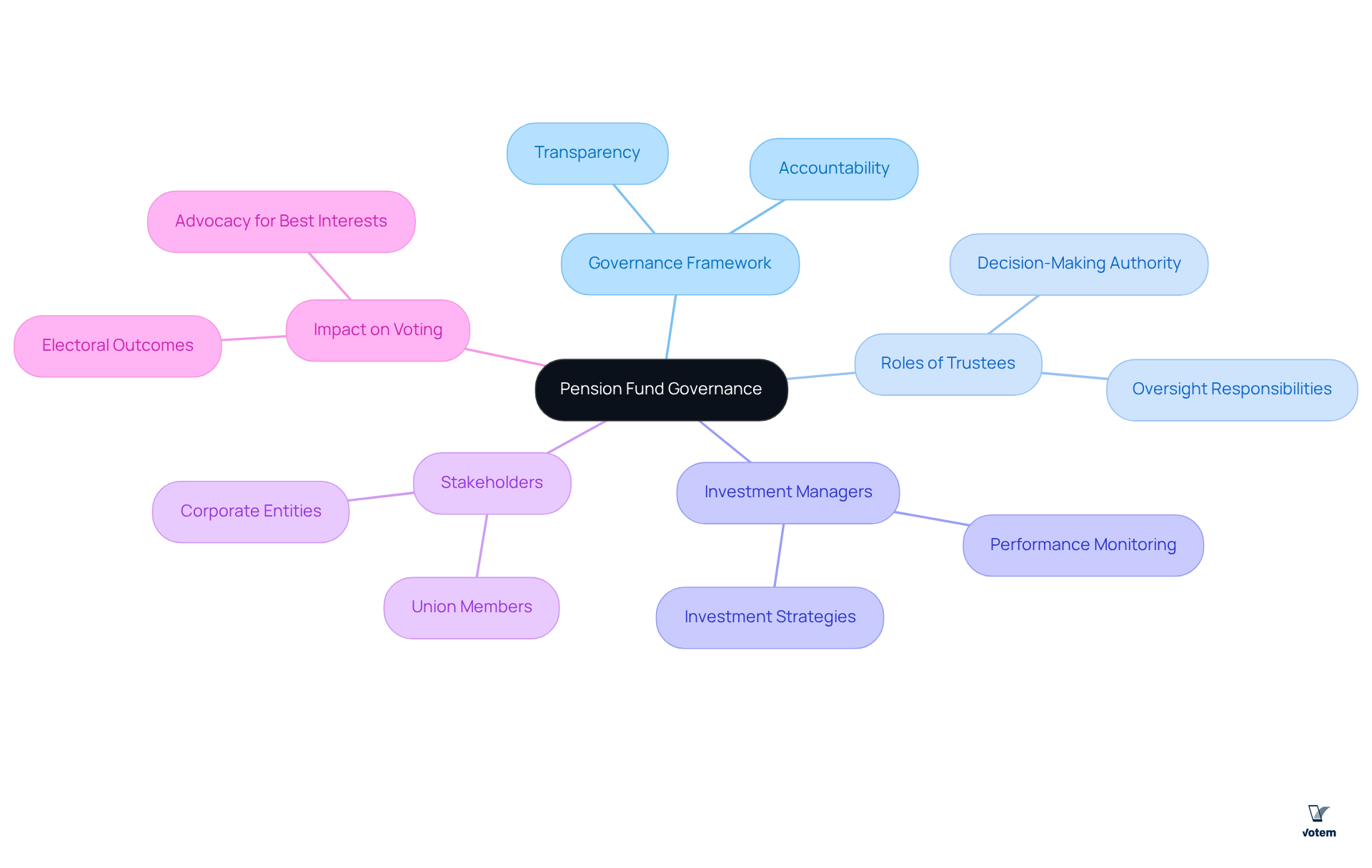

Understand Pension Fund Governance and Its Impact on Voting

Pension fund governance encompasses the rules, practices, and processes that guide the management and oversight of these funds. For union members, understanding the governance framework—including the roles of trustees, investment managers, and stakeholders—is essential. Effective governance prioritizes the interests of beneficiaries, significantly impacting electoral outcomes on pivotal issues such as investment strategies, corporate governance policies, and pension fund voting. A strong governance model, for instance, promotes accountability and transparency, resulting in more informed decision-making.

Union leaders must familiarize themselves with the specific applicable to their pension funds, as these can vary widely across organizations and jurisdictions. This understanding enables them to advocate for approaches that align with their constituents’ best interests, ultimately fostering a more democratic electoral atmosphere. Furthermore, as pointed out by industry specialists, an educated leadership can drive beneficial transformation in governance practices, ensuring that union participants’ voices are effectively represented in crucial decision-making situations.

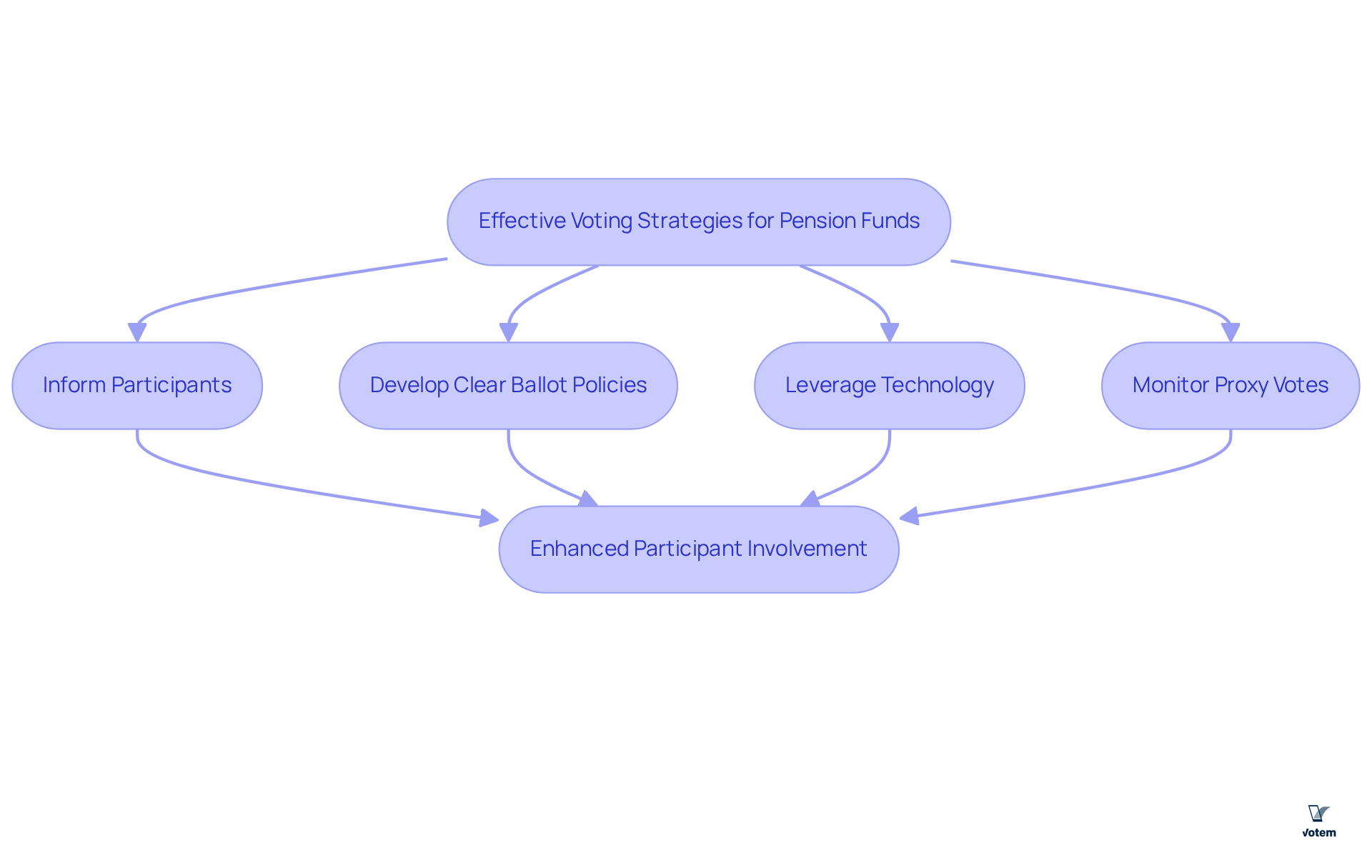

Implement Effective Voting Strategies for Pension Funds

To implement effective ballot strategies for pension funds, unions must consider several key approaches:

- Inform Participants: Conduct workshops and informational sessions to educate union participants about the election process, the importance of their choices, and the issues involved. This proactive engagement can significantly boost turnout and participation.

- Develop Clear Ballot Policies: Establish transparent ballot policies that clearly outline how votes will be cast and the criteria for decision-making. This openness cultivates trust among participants and guarantees their voices are effectively represented.

- Leverage Technology: Utilize secure online platforms, such as Votem’s innovative solutions, to facilitate participation. Votem’s platforms and simplify the election process, enabling engagement for participants from any location. For instance, implementing Votem’s mobile-first user experience can significantly boost turnout, as evidenced by Votem’s success in helping deliver 123,000 votes—more than double the turnout of the last election in 2015.

- Monitor Proxy Votes: Actively monitor and analyze proxy votes to ensure alignment with the union’s values and objectives. Collaborating with investment managers can support the promotion of responsible electoral procedures that represent the concerns of union participants.

By adopting these strategies, unions can enhance their influence in pension fund voting and ensure that outcomes align with the best interests of those they represent. Embracing these approaches is essential for improving participant involvement and guaranteeing that their opinions are acknowledged in important electoral choices.

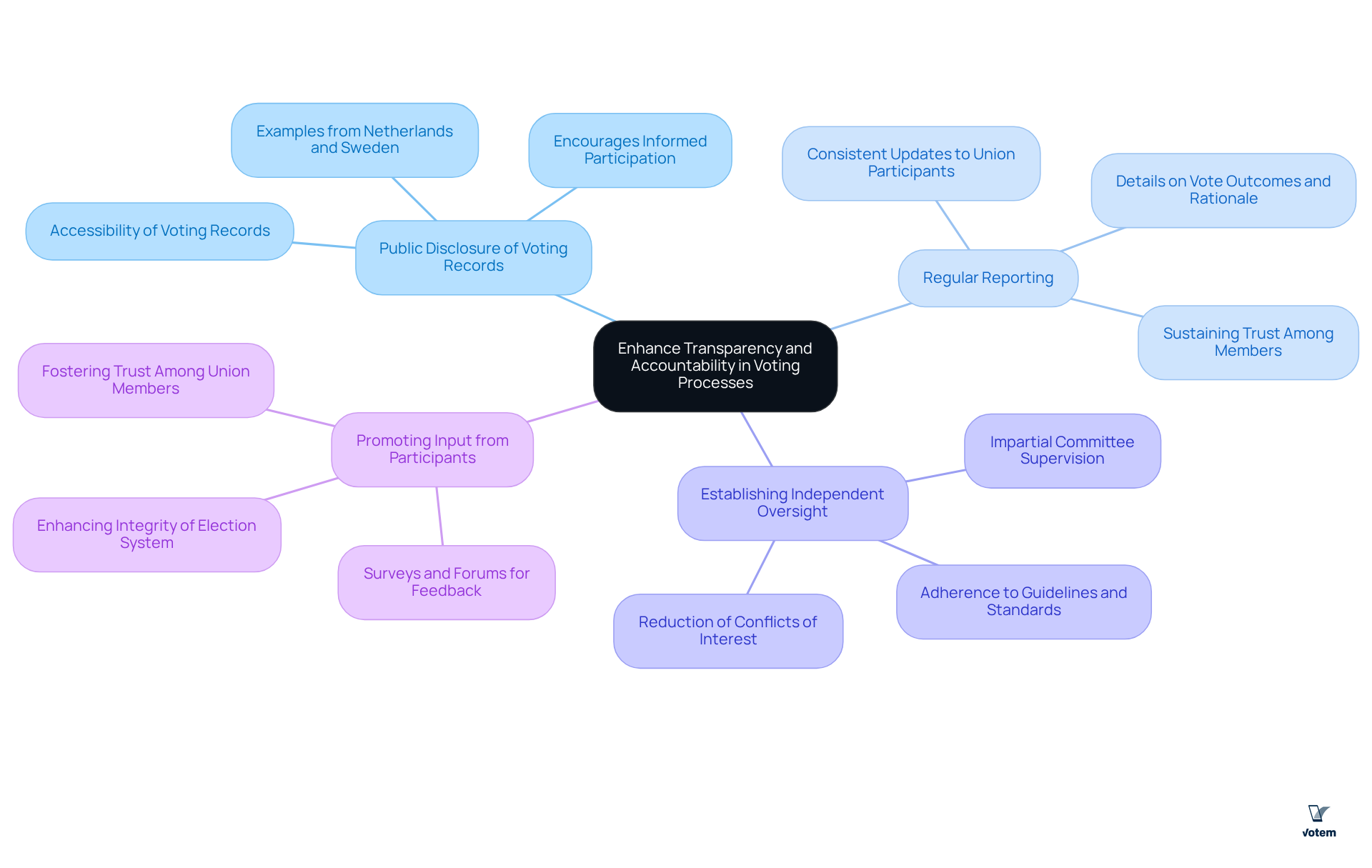

Enhance Transparency and Accountability in Voting Processes

Improving openness and responsibility in pension fund voting decision-making procedures can be achieved through several optimal methods.

- Public Disclosure of Voting Records is crucial; ensuring that all voting records are publicly accessible allows individuals to review how their representatives voted on key issues. This practice fosters accountability and encourages informed participation. Notably, pension fund voting by those that prioritize transparency, such as those in the Netherlands and Sweden, consistently favors sustainability measures, demonstrating the effectiveness of this approach.

- Regular Reporting is another essential method. Providing consistent reports to union participants detailing the outcomes of votes, the rationale behind decisions, and any changes in governance policies keeps members informed and involved in the decision-making process. Frequent updates are vital for sustaining trust and participation among union members.

- Establishing Independent Oversight is also imperative. Appointing an impartial committee to supervise elections ensures adherence to established guidelines and ethical standards. This measure reduces conflicts of interest and enhances trust in the process, as evidenced by successful governance models among various pension funds that have embraced .

- Promoting Input from Participants is equally important. Establishing avenues for participants to share their thoughts on election practices and results, such as surveys or forums, allows them to express their views and recommendations. Involving participants in this manner not only enhances the integrity of the election system but also fosters increased trust among union members.

By adopting these methods, unions can significantly improve the reliability of their electoral systems, which is essential for ensuring effective pension fund voting, ultimately resulting in heightened member involvement and responsibility. Furthermore, leveraging technology like Votem’s CastIron platform can facilitate these best practices by ensuring secure, compliant, and transparent voting processes. This, in turn, enhances voter confidence and participation. Testimonials from satisfied customers underscore the effectiveness of Votem’s solutions in achieving these goals.

Conclusion

Understanding the complexities of pension fund governance is critical for unions aiming to enhance their voting effectiveness. By prioritizing the interests of beneficiaries and ensuring accountability, unions can navigate the intricacies of pension fund voting with greater confidence. A well-informed leadership is essential not only for advocating on behalf of union members but also plays a pivotal role in fostering a more democratic electoral environment.

To improve pension fund voting, unions should focus on three key strategies:

- Educating participants

- Establishing clear ballot policies

- Leveraging technology for accessibility

By implementing these approaches, unions can significantly increase member engagement and ensure that their collective voice is heard in crucial decisions. Furthermore, enhancing transparency and accountability through public disclosure of voting records and independent oversight solidifies trust among union members and promotes informed participation.

Ultimately, the significance of these strategies extends beyond mere voting practices; they represent a commitment to democratic principles and the empowerment of union members. By actively engaging in these best practices, unions not only bolster their influence in pension fund governance but also pave the way for a more equitable and responsible decision-making process. Embracing these strategies is imperative for ensuring that the voices of union participants resonate in the voting process, shaping the future of their pension funds.

Frequently Asked Questions

What is pension fund governance?

Pension fund governance refers to the rules, practices, and processes that guide the management and oversight of pension funds.

Why is understanding pension fund governance important for union members?

It is essential for union members to understand the governance framework, including the roles of trustees, investment managers, and stakeholders, as it significantly impacts electoral outcomes on key issues such as investment strategies and corporate governance policies.

How does effective governance impact decision-making in pension funds?

Effective governance prioritizes the interests of beneficiaries, promotes accountability and transparency, and results in more informed decision-making.

What should union leaders do regarding pension fund governance?

Union leaders should familiarize themselves with the specific governance guidelines applicable to their pension funds to advocate for approaches that align with their constituents’ best interests.

How can educated leadership influence pension fund governance?

Educated leadership can drive beneficial transformation in governance practices, ensuring that union participants’ voices are effectively represented in crucial decision-making situations.

List of Sources

- Understand Pension Fund Governance and Its Impact on Voting

- The Singular Role of Public Pension Funds in Corporate Governance (https://ecgi.global/publications/blog/the-singular-role-of-public-pension-funds-in-corporate-governance)

- Railpen updates on 2025 voting policy (https://professionalpensions.com/news/4387220/railpen-updates-2025-voting-policy)

- Voting Rights: The Hidden Power in Your Pension (https://laudesfoundation.org/latest/news-and-stories/stories/2025/voting-rights-the-hidden-power-in-your-pension)

- 2025 Proxy Season: Key Votes for Pensions to Watch (https://texpers.memberclicks.net/?option=com_dailyplanetblog&view=entry&year=2025&month=04&day=08&id=317:2025-proxy-season-key-votes-for-pensions-to-watch)

- Biden releasing nearly $36B to aid pensions of union workers (https://apnews.com/article/biden-business-united-states-government-and-politics-retirees-09d93d2af8cc68de47eccda4a9ef0250)

- Implement Effective Voting Strategies for Pension Funds

- New York City and State Pension Funds Launch “VOTE NO” Campaign Against Against the Re-election of Two Amazon Board Directors Responsible for Oversight of Human Capital Management (https://comptroller.nyc.gov/newsroom/new-york-city-and-state-pension-funds-launch-vote-no-campaign-against-against-the-re-election-of-two-amazon-board-directors-responsible-for-oversight-of-human-capital-management)

- Second annual report analyzes major public pensions’ responses to the climate crisis in proxy voting – Climate Safe Pensions (https://climatesafepensions.org/release-hidden-risk-pensions-report-2025)

- bls.gov (https://bls.gov/news.release/union2.htm)

- PLSA Stewardship & Voting Guidelines (https://pensionsuk.org.uk/Policy-and-Research/Document-library/PLSA-Stewardship-Voting-Guidelines)

- Enhance Transparency and Accountability in Voting Processes

- PSERS Board Endorses Enhanced Investment Transparency Standards (https://pa.gov/agencies/psers/newsroom/032120251.html)

- Voting Rights: The Hidden Power in Your Pension (https://laudesfoundation.org/latest/news-and-stories/stories/2025/voting-rights-the-hidden-power-in-your-pension)

- Allen Holds Hearing on Enhancing Transparency and Oversight at EBSA (https://edworkforce.house.gov/news/documentsingle.aspx?DocumentID=412662)